Disruption or evolution?

DATA STRATEGY QUICK CHECK

Check your data maturity with our free tool developed by leading business analysts and get actionable insights.

Technology driven Innovation

Fintechs:

opportunities or threats?

Although corporate banks still enjoy a competitive advantage and high level of trust, returns offered by digital businesses, low capital requirements, and a lightly regulated market [7] attract financial technology firms, often referred to as Fintechs [10]. Anyway, those players still struggle to provide financial solutions at scale. The analysis of Schnarr et al. [9] highlights that new digital channels could threaten banks’ direct access to clients, offering a rich digital experience. Furthermore, the emergence of single-purpose services in combination with increasing regulations erodes margins, requiring new means of efficiency.

Digital Champions

Incumbents 81%

Challengers 19%

Conclusion

Digitalization will be a cornerstone of banks’ business strategies for several years, demanding cutting-edge solutions that enable them to meet clients’ augmented expectations quickly and dynamically.

References

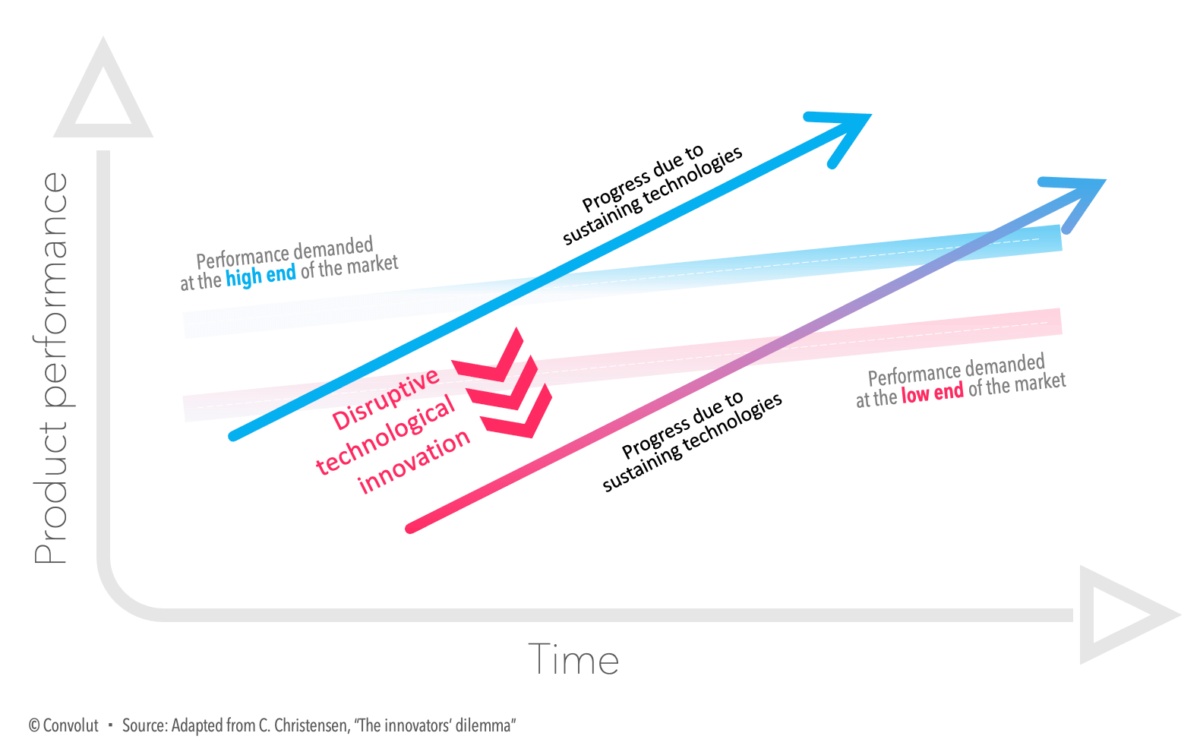

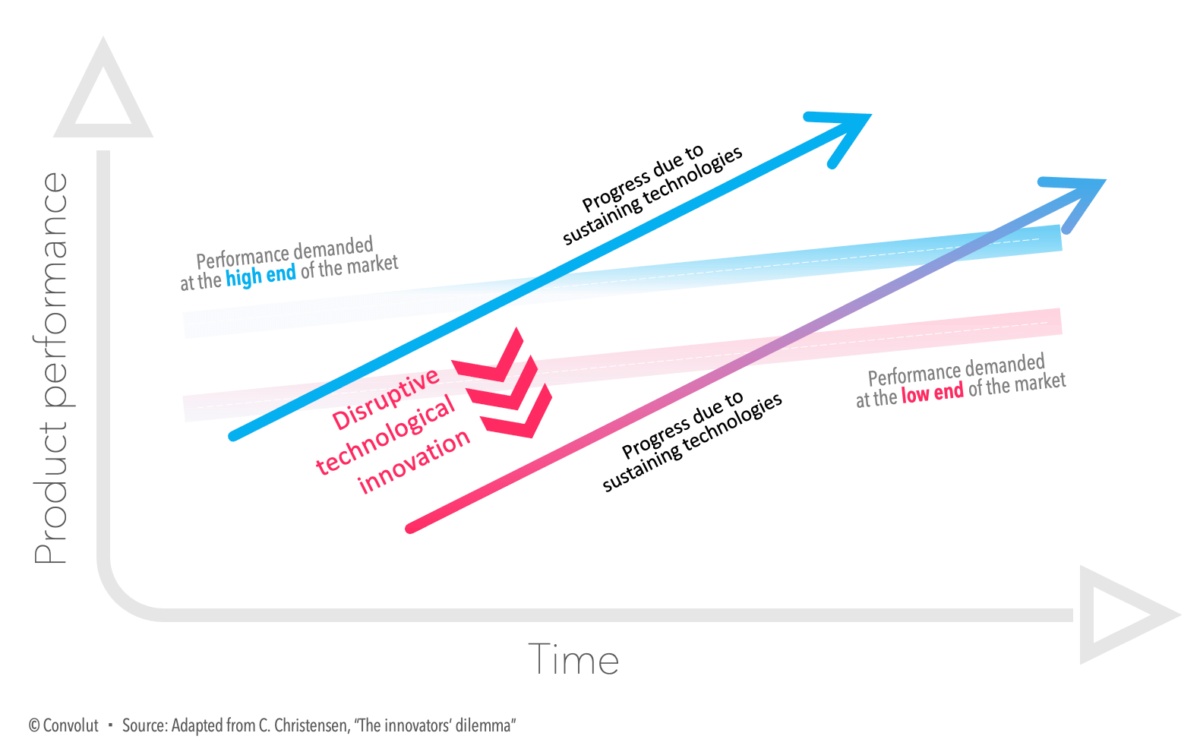

[2] C. Christensen, The innovator’s dilemma. When new technologies cause great firms to fail, 3rd ed., Boston: Harvard Business Review Press, 2016.

[3] J. Loucks, J. Macaulay, A. Noronha and M. Wade, Digital Vortex: How Today’s Market Leaders Can Beat Disruptive Competitors at Their Own Game, I. I. f. M. Development, Ed., Lausanne: International Institute for Management Development, 2016.

[4] Gilbert, “The disruption opportunity“, MIT Sloan Management Review, pp. 17-32, 2003.

[5] S. S., “Retail Banking Survey: Not striving for any change of business models despite digitalization“, Roland Berger, Munich, 2021.

[6] J. Galbraith, “Organization design challenges resulting from big data“, Journal of Organization Design, vol. 3, no. 1, pp. 2-13, 2014.

[7] O. Pakhnenko, P. Rubanov, D. Hacar, V. Yatsenko and I. Vida, “Digitalization of financial services in European countries: Evaluation and comparative analysis,” Journal of International Studies, vol. 14, no. 2, pp. 267-282, 2021.

[8] J. Bughin, E. Hazan, E. Labaye, J. Manyika, P. Dahlström, S. Ramaswamy and C. de Billy, “Digital Europe: Pushing the frontier, capturing the benefits“, 06 2016.

[9] T. Schnarr and M. Pfeiffer, “Delivering excellence in corporate banking. How to protect the business model and improve performance“, Oliver Wyman, 2015

[10] J. Dahl, M. Dietz, O. Timchenko, S. Krylov, I. Kubar and A. Sun-Basorun, “Reaching for the stars: Digital innovation in emerging market banking” , McKinsey & Company, 2016.

[11] Deloitte, “Digital Banking Maturity 2020“, 2021.

[12] M. Eitel, C. Gerlach, R. Simmons and S. Lam, “Regulatory Guidance Regarding FinTech Products and Services“, 2016.

[13] S. Saluja, P. M., E. Van der Ouderaa, P. Gera, S. Lillis and F. Caminiti, “European Financial Services Digital Readiness Index Report“, 2016.

[14] GFT Technologies SE, “Digital Banking Expert Survey 2016” GFT Technologies SE, 2016.

SERVICES

How we can help you

Regulatory Compliance

Calculation Engines

Data Governance

Über den Autor