Disruption or evolution?

DATA STRATEGY QUICK CHECK

Check your data maturity with our free tool developed by leading business analysts and get actionable insights.

Technology driven Innovation

Fintechs:

opportunities or threats?

Although corporate banks still enjoy a competitive advantage and high level of trust, returns offered by digital businesses, low capital requirements, and a lightly regulated market [7] attract financial technology firms, often referred to as Fintechs [10]. Anyway, those players still struggle to provide financial solutions at scale. The analysis of Schnarr et al. [9] highlights that new digital channels could threaten banks’ direct access to clients, offering a rich digital experience. Furthermore, the emergence of single-purpose services in combination with increasing regulations erodes margins, requiring new means of efficiency.

Digital Champions

Incumbents 81%

Challengers 19%

Conclusion

Digitalization will be a cornerstone of banks’ business strategies for several years, demanding cutting-edge solutions that enable them to meet clients’ augmented expectations quickly and dynamically.

References

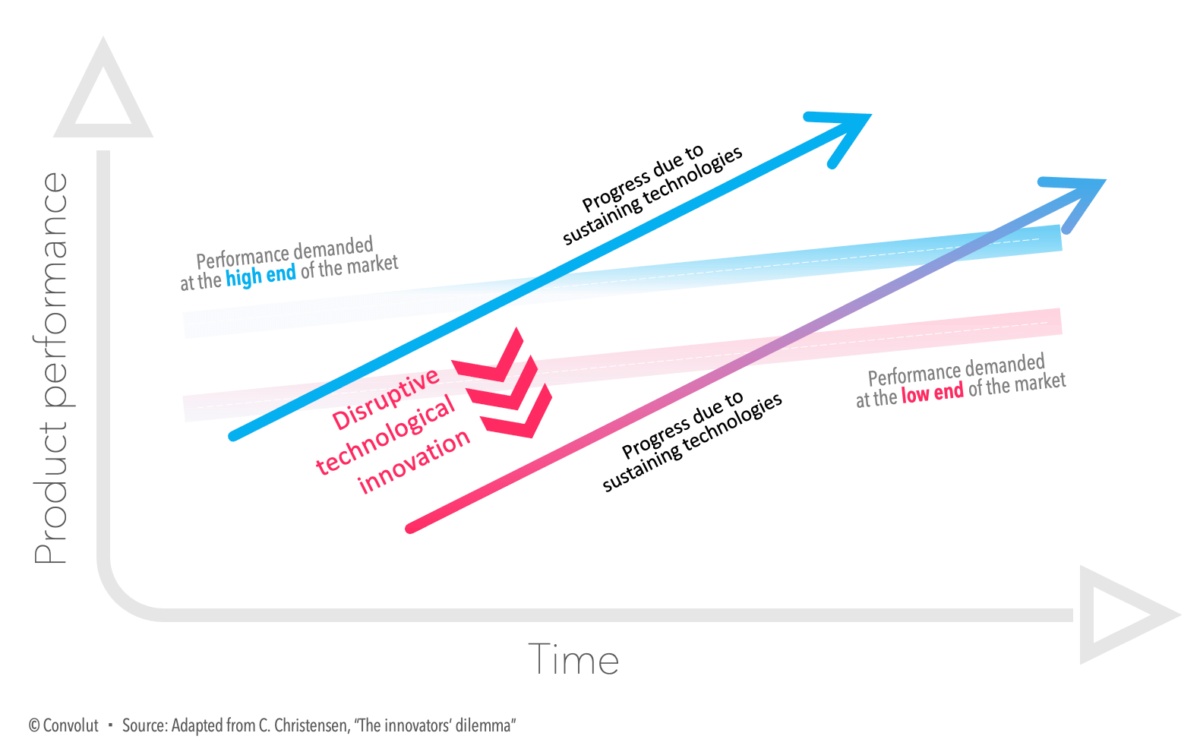

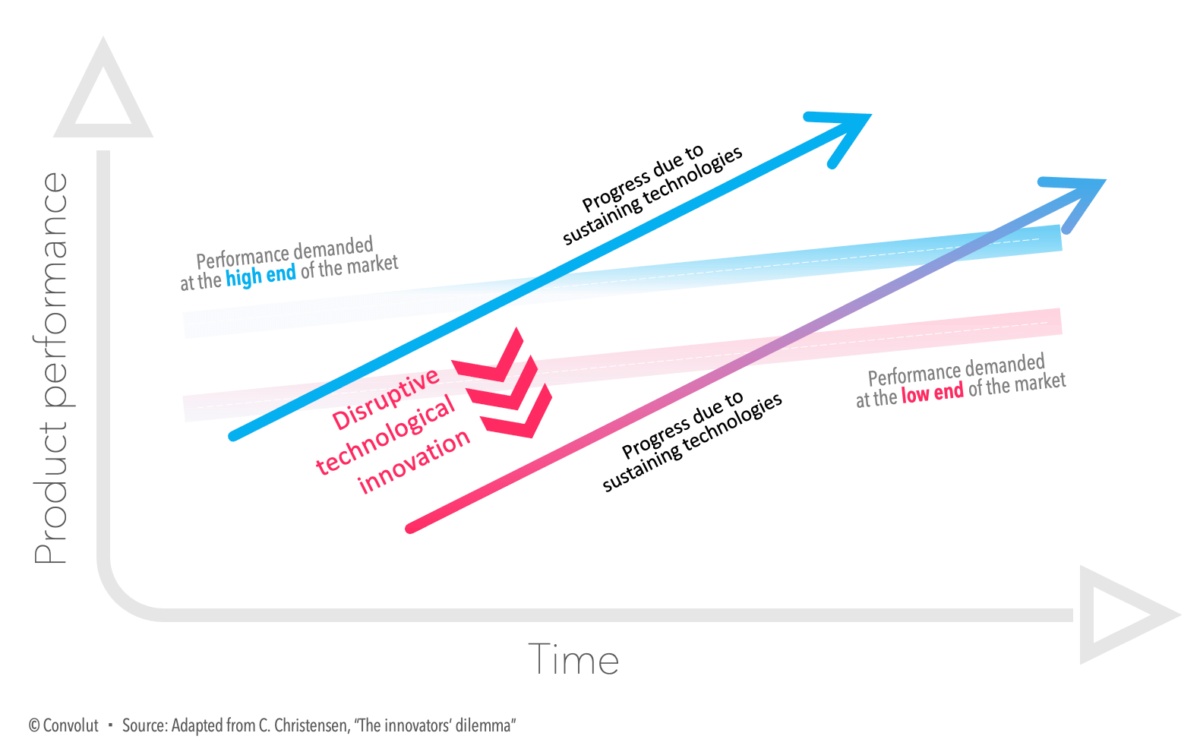

[2] C. Christensen, The innovator’s dilemma. When new technologies cause great firms to fail, 3rd ed., Boston: Harvard Business Review Press, 2016.

[3] J. Loucks, J. Macaulay, A. Noronha and M. Wade, Digital Vortex: How Today’s Market Leaders Can Beat Disruptive Competitors at Their Own Game, I. I. f. M. Development, Ed., Lausanne: International Institute for Management Development, 2016.

[4] Gilbert, “The disruption opportunity“, MIT Sloan Management Review, pp. 17-32, 2003.

[5] S. S., “Retail Banking Survey: Not striving for any change of business models despite digitalization“, Roland Berger, Munich, 2021.

[6] J. Galbraith, “Organization design challenges resulting from big data“, Journal of Organization Design, vol. 3, no. 1, pp. 2-13, 2014.

[7] O. Pakhnenko, P. Rubanov, D. Hacar, V. Yatsenko and I. Vida, “Digitalization of financial services in European countries: Evaluation and comparative analysis,” Journal of International Studies, vol. 14, no. 2, pp. 267-282, 2021.

[8] J. Bughin, E. Hazan, E. Labaye, J. Manyika, P. Dahlström, S. Ramaswamy and C. de Billy, “Digital Europe: Pushing the frontier, capturing the benefits“, 06 2016.

[9] T. Schnarr and M. Pfeiffer, “Delivering excellence in corporate banking. How to protect the business model and improve performance“, Oliver Wyman, 2015

[10] J. Dahl, M. Dietz, O. Timchenko, S. Krylov, I. Kubar and A. Sun-Basorun, “Reaching for the stars: Digital innovation in emerging market banking” , McKinsey & Company, 2016.

[11] Deloitte, “Digital Banking Maturity 2020“, 2021.

[12] M. Eitel, C. Gerlach, R. Simmons and S. Lam, “Regulatory Guidance Regarding FinTech Products and Services“, 2016.

[13] S. Saluja, P. M., E. Van der Ouderaa, P. Gera, S. Lillis and F. Caminiti, “European Financial Services Digital Readiness Index Report“, 2016.

[14] GFT Technologies SE, “Digital Banking Expert Survey 2016” GFT Technologies SE, 2016.

HOW WE CAN HELP YOU FURTHER

Related Services

Business Analysis

Solution Design

Smart Reporting

Intelligent Process Automation

Robotic Process Automation

Architecture Modernization

About the Author